Overall, funded major project work in the pipeline is equal to $960m, equivalent to an average per annum spend of $192m. Having said that, this year’s pipeline represents an improvement due to an increase in funded transport infrastructure. Outlook: Major project activity in the Wide Bay region has a similar issue to many other regions – a large proportion (63%) of work in the pipeline is unfunded. The negative outlook for this region is further highlighted by the proportion of unfunded project activity which is considered ‘unlikely’ – more than 50% of the $3bn unfunded total. This includes $1.7bn in unfunded major coal projects, the largest being the Minyango Coal Project worth $600m.

94% of activity in the pipeline is currently unfunded, comprising a host of resource projects spread across minerals, coal and gas. The outback region has the lowest ratio of funded to unfunded major project work.

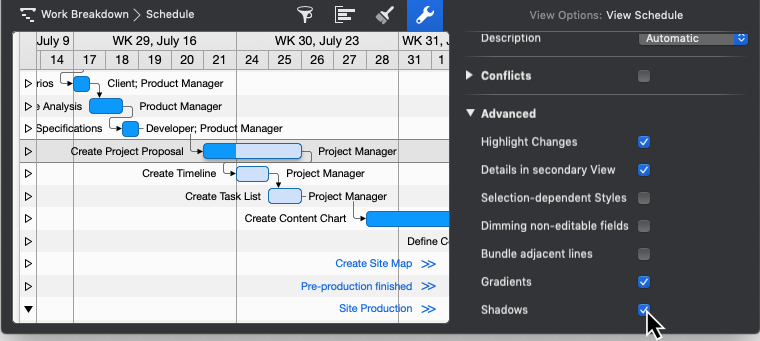

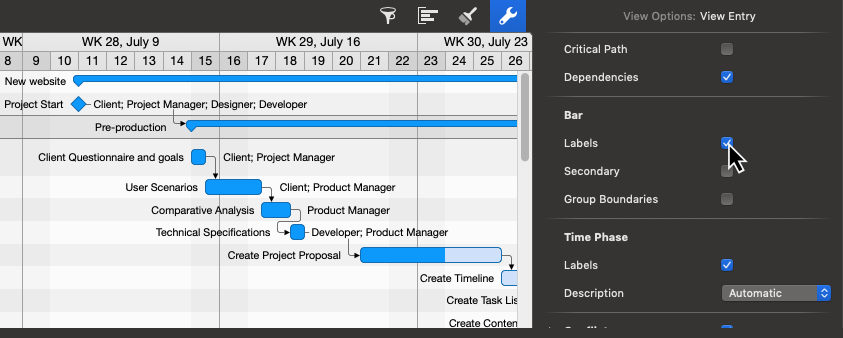

ADD SUMMARY IN MERLIN PROJECT UPGRADE

Funded activity only peaks at $82m in 2022/23, supported by a section of the $238m Mt Isa to Rockhampton Corridor Upgrade and the $120m Aldoga Solar Farm. In 2019/20 there is only $70m in funded activity, while $225m remains unfunded. Outlook: The regional profile for the Outback – an area that covers approximately two-thirds of Queensland – is distinct from the other regions due to its low population and historical reliance on resource related activity. Source: BIS Oxford Economics, QMCA and IAQ member knowledge The biggest ‘winners’ are Darling Downs-Maranoa and Townsville which are forecast to have $1.1bn and $517m more funded work in the next 5 years respectively, compared to last year’s outlook.Ĭhart B2.2: Funded Major Project Work over the next 5 years by Region, $b The outlook has become more favourable across some regions compared to last year, while other regions find themselves worse off. Publicly funded transport expenditure accounts for 65% of total funded project work in the pipeline – in fact, the Cairns and Gold Coast regions rely entirely on road and rail major project work in the next five years.

Queensland and Australian Government spending on transport infrastructure is driving the improved outlook for many regions. Within these regions, 26% of the unfunded work is considered unlikely, 23% prospective and the remaining 51% credibly proposed. In particular, two regions – Outback and Mackay-Isaac − have 52% of total unfunded work in the pipeline, equivalent to $11.6bn over the five years. Unfunded work is more evenly spread among the regions, although more concentrated in central and northern Queensland. Conversely, the slowest growing regions are Fitzroy and Outback, which are expected to see average funded work over next five years around 80% lower than the previous 5 years. Ipswich, Toowoomba, Logan and Beaudesert region and Darling Downs, Maranoa region are the second largest regions for major project work, each make up 13% (approximately $3.5bn each) of funded work in the pipeline. These areas are expected to see a doubling in average levels of funded activity over the next five years compared to 2014/15 to 2018/19. South East Queensland, and adjacent regions such as Wide Bay and Darling Downs-Maranoa are also expected to experience the strongest project growth. Other regional and rural Queensland accounts for the remaining 50%% of the funded pipeline, reflecting the need for infrastructure (as well as industrial opportunity) in Australia’s second largest, and most decentralised, state. This region represents 71% of Queensland’s population (3.6 million) and accounts for 50% ($13.3bn) of the funded pipeline.

South East Queensland (SEQ) includes Greater Brisbane, the Sunshine Coast, Gold Coast and Ipswich-Toowoomba-Logan. This is primarily driven by major transport projects such as Cross River Rail, Brisbane Metro and sections of the Pacific Motorway. Greater Brisbane has the greatest concentration of funded work, making up 27% of all funded work in Queensland over the next five years. Greater Brisbane and Ipswich-Toowoomba-Logan account for 40% of funded major project work in the pipeline.

0 kommentar(er)

0 kommentar(er)